Latest Dynamic Cycle Chart of Gold (12/10/2023)

October 12, 2023

February 2024 T&Y RRI™ (14/3/2023)

March 14, 20243 Important Reasons Why 2024 Will Be Red-Hot for Crypto (2/3/2024)

** Please note that any information shared in this private blog is NOT to be regarded as an advice or a recommendation, it is meant for EDUCATIONAL AND INFORMATION PURPOSES only and it does not constitute an investment advice, an offer or solicitation to purchase or sell the investment asset classes mentioned. **

There are 3 pivotal developments which I think will create a near-perfect environment for massively higher crypto asset prices in 2024.

1) Approval of the 11 Bitcoin (BTC) spot ETFs on 10th January 2024

The approvals of the above 11 Bitcoin spot ETFs open the floodgates for the vast ocean of global capital to pour into crypto for the first time. BlackRock is 1 of the successful BTC ETF applicants. It’s 1 of the world’s biggest institutional investors, with US$9.1 trillion under management. If just 1% of that amount flows into its new Bitcoin ETF — either from funds already under management or new money — it would create a groundswell of US$91 billion. And BlackRock is only one of 11 BTC ETFs approved by the U.S. SEC. Other big players include Franklin Templeton, Fidelity, Grayscale, Invesco, VanEck, WisdomTree and more. Grayscale has the potential to drive up crypto prices in a big way, thanks to its huge, already existing Bitcoin stash of US$27+ billion. Meanwhile, investors with a Fidelity account can now simply log in and buy Bitcoin via its new Wise Origin Bitcoin Trust ETF (FBTC) – this means 86 million Fidelity accounts now have easy access to the No. 1 crypto by market cap.

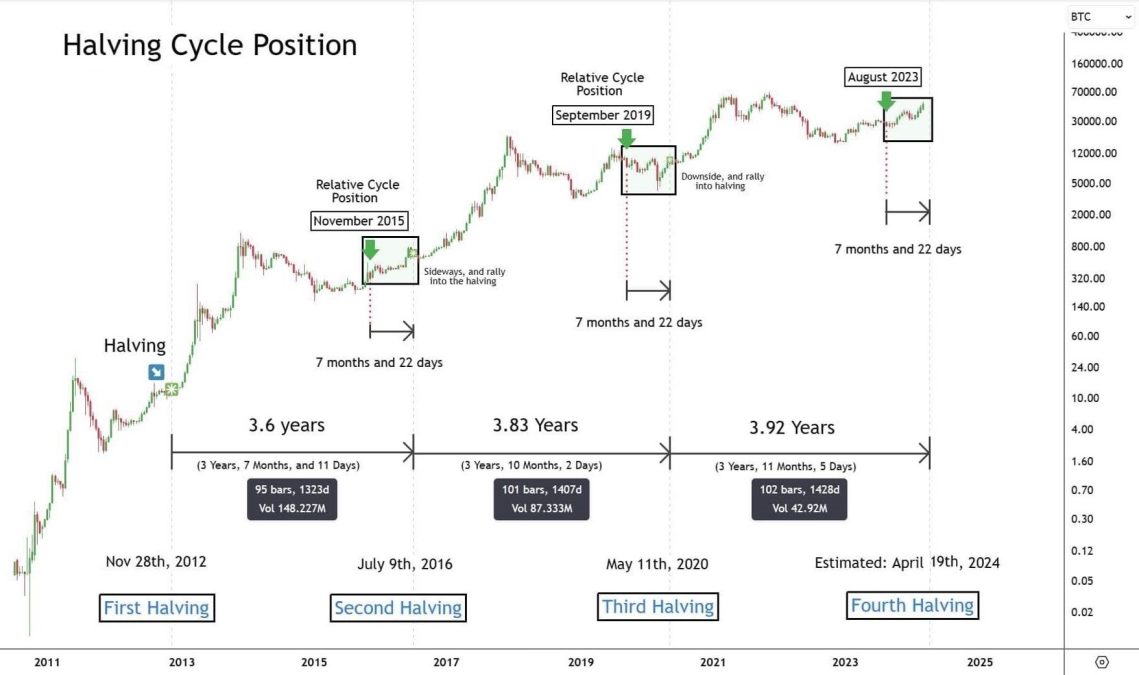

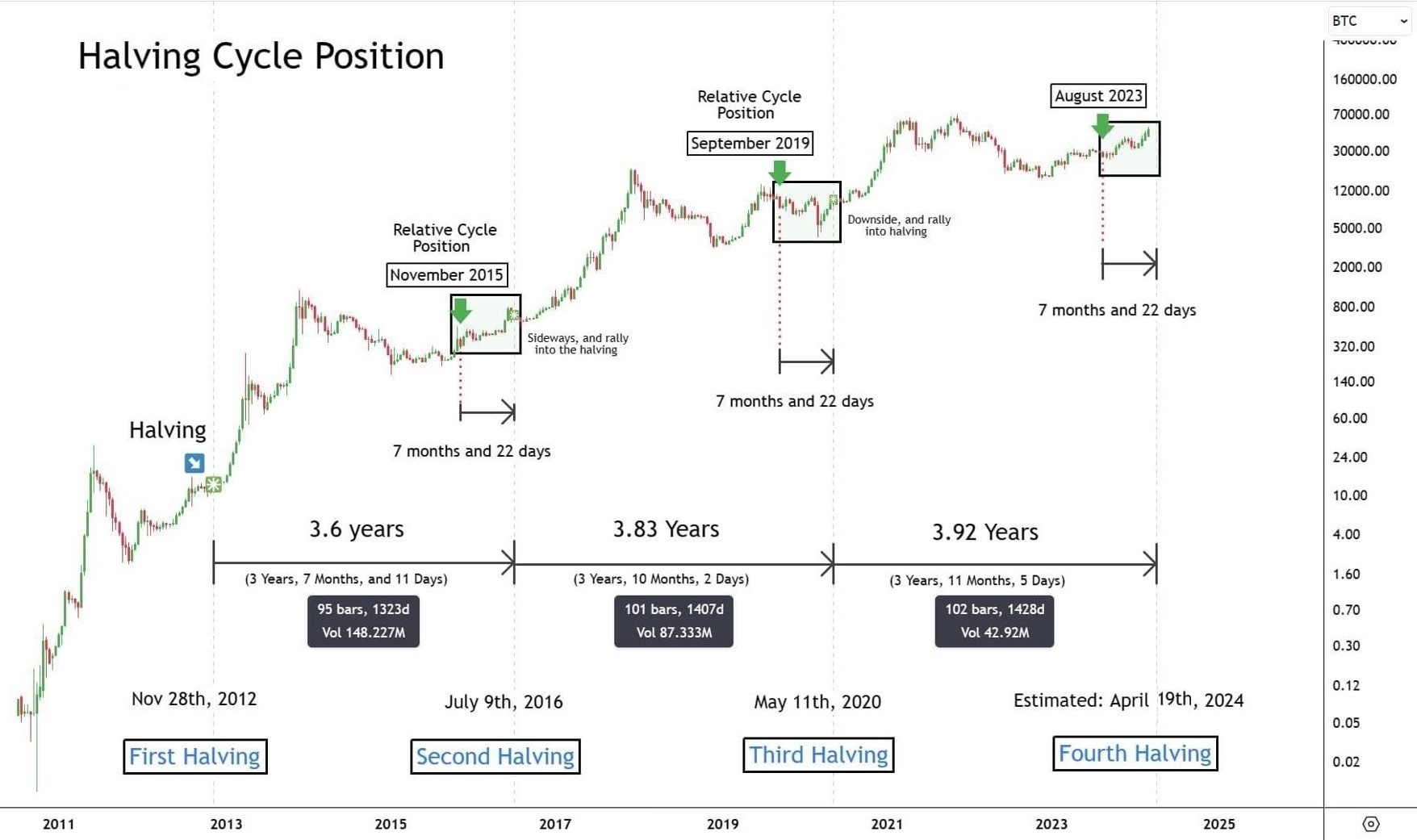

2) Bitcoin’s 4th Halving

There’s a hard ceiling on the maximum number of Bitcoin that can ever be created. It’s 21 million BTC, a number hardwired in the depths of the Bitcoin blockchain. And of this amount, 93.3% have already been minted.

That means only 6.7% of the total supply is still available to enter the market.

But that’s not all. We can’t tap into the full remaining supply at once just because demand increases. That’s because supply is determined by the mining reward. Bitcoins enter circulation as payment. A miner validates a block on Bitcoin’s blockchain — basically approving the transaction recorded in that block. And in return, the miner is given a set number of BTC as a reward. As of right now, a block reward is 6.25 BTC. It’s the nature of the market that there are only 1 or 2 million actual physical Bitcoins available for purchase at any given moment. And supply is already set to tighten this spring, following Bitcoin’s scheduled 4th halving event. This is when the reward for mining – and thus the rate at which new Bitcoin is created – is cut into half. After this spring, the mining reward will be 3.125 BTC.

In other words, there’s zero hope of any meaningful increase in supply. That makes Bitcoin one of the most restrictive of any asset class in the world that anybody can invest in. The basic principles of economics still apply to crypto – soaring demand plus a lessening supply means prices are clear for takeoff.

3) We are NOW in the Bullish phase of the 4-Year Crypto Cycle

1st year is a bear market – ended in November 2022 and entered into the bullish phase for Bitcoin.

2nd year is a transition phase – crypto assets were stuck in a consolidation phase for most of the 2023.

3rd year starts the true bull run – this is where we are NOW and we can expect a big bull run as 2024 progresses.

4th year takes the bull market to the next level. Historically, the magnitude of BTC’s rally after each halving has been decreasing. But I am expecting the magnitude of rally after the coming 4th halving on 19th April 2024 to INCREASE rather than reduce as compared to the previous 3 halving because of the 1st reason of massive amount global capital waiting to flow into the crypto market.

After breaking above US$60,000 for the the 1st time since 2021, BTC kept going up to touch US$64,000 before pulling back just a bit. I am amazed because I have never seen BTC challenge an All-Time-High so early in the bull cycle. This signifies that an incredibly strong bull market is ahead of us and technically I am expecting BTC to at least challenge US$100,000 by the time this bull market is over.

** Please note that any information shared in this private blog is NOT to be regarded as an advice or a recommendation, it is meant for EDUCATIONAL AND INFORMATION PURPOSES only and it does not constitute an investment advice, an offer or solicitation to purchase or sell the investment asset classes mentioned. **

![[Nov2022]_T_Y 2.0 – Black Transparent@2x](https://timingandyou.com/core/wp-content/uploads/2022/12/Nov2022_T_Y-2.0-Black-Transparent@2x.png)