Watch Out For The Smoothed U.S. Recession Probabilities Index!

February 15, 2023** Please note that any information shared in this private blog is NOT to be regarded as an advice or a recommendation, it is meant for EDUCATIONAL AND INFORMATION PURPOSES only and it does not constitute an investment advice, an offer or solicitation to purchase or sell the investment asset classes mentioned. **

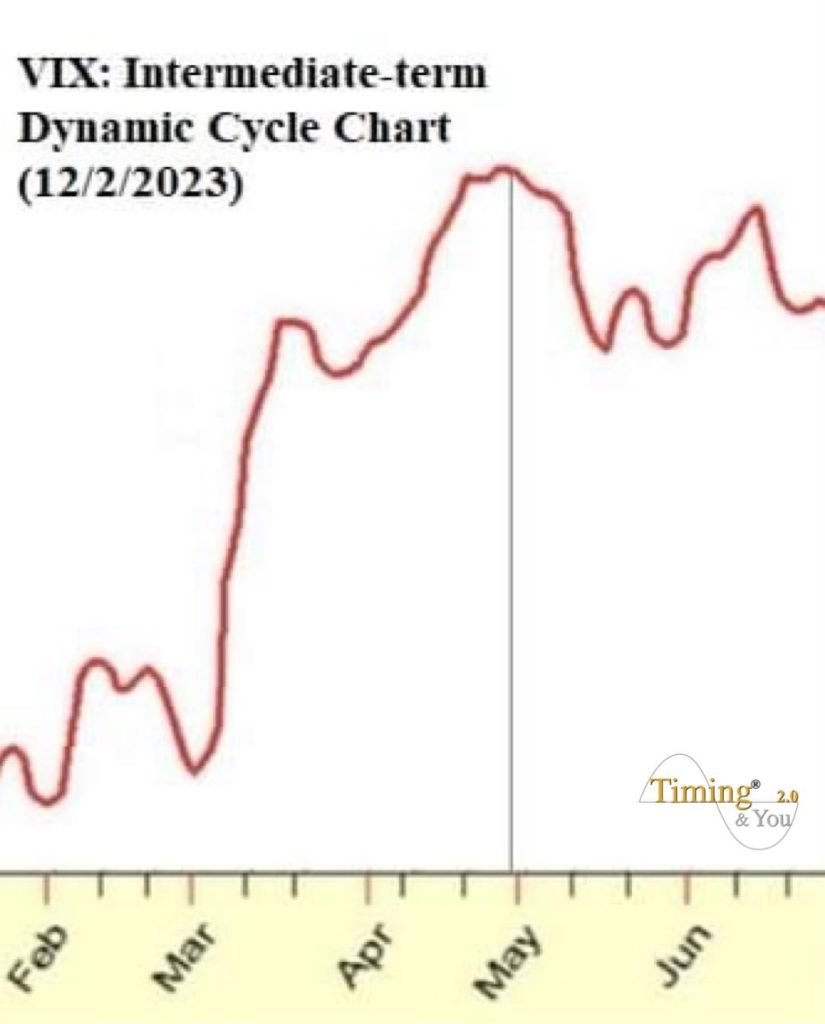

This is the latest Dynamic Cycle Chart of VIX crunched on 12/2/2023. VIX (Chicago Board Options Exchange Volatility Index) is a measure of the expected volatility of the U.S. stock market. It is often referred to as the market’s ‘fear gauge’. Generally, VIX move up when the market is falling. The reverse is true when the market advances — VIX decline.

The next Turning Point in VIX is PROBABLY towards late April/early May, suggesting that VIX and volatility MAY move up, as a result U.S. stock market MAY weaken going forward.

Historically, up to 20% bounces are normal in bear markets. It is important not to assume a new bull market started every time there is such a bounce. There should still be another leg down in the U.S. stock market, like what I shared during our market update on 15/1/2023. This MAY give us the opportunity to get low risk entry levels to go long in stocks. I will go into more details on this during our Stagflation Protection Plan (SPP) class on 25/2/2023.

** Please note that any information shared in this private blog is NOT to be regarded as an advice or a recommendation, it is meant for EDUCATIONAL AND INFORMATION PURPOSES only and it does not constitute an investment advice, an offer or solicitation to purchase or sell the investment asset classes mentioned. **

![[Nov2022]_T_Y 2.0 – Black Transparent@2x](https://timingandyou.com/core/wp-content/uploads/2022/12/Nov2022_T_Y-2.0-Black-Transparent@2x.png)